Sunday, August 10, 2025

Next-Generation Insurance Sales: Socially Intelligent Voice AI Agents for Higher Efficiency, Conversions, and Customer Delight

Insurance sales remains one of the most relationship-driven yet operationally costly sectors in financial services. Conversion rates are often low, as generic scripts and rigid workflows fail to adapt to each prospect’s unique priorities and concerns. Human labor costs continue to rise, with significant resources spent on training and retaining sales staff. Existing AI sales solutions have yet to earn full trust—they tend to be overly scripted, struggle with complex product details, and lack the ability to flexibly adjust sales strategies mid-conversation. What the industry needs is a new class of socially intelligent voice AI agents—systems that can dynamically tailor their sales approach, possess deep knowledge of insurance products, empathize with customers, and deliver a superior, human-like customer experience at scale.

Social Intelligence is the Key to Solving These Challenges

In insurance sales, success depends not only on product knowledge but on the ability to read the customer’s signals, adapt tone and strategy in real time, and build trust through authentic engagement. This is the essence of social intelligence—the capability to interpret verbal and non-verbal cues, understand emotional context, and adjust communication accordingly. A socially intelligent voice AI agent can detect hesitation, interest, or confusion in a prospect’s voice; shift seamlessly between educating, reassuring, and persuading; and choose the most effective sales tactic for that individual customer. By combining deep insurance product expertise with empathy-driven dialogue, such an agent can overcome objections more naturally, maintain engagement throughout the sales cycle, and create the kind of positive customer experience that drives both immediate conversions and long-term loyalty.

Core Capabilities of a Socially Intelligent Voice AI Agent

To address the unique demands of insurance sales, a socially intelligent voice AI agent must integrate four essential capabilities:

- Emotional and Sentiment Detection

Analyze tone, pace, and word choice to identify customer sentiment—such as curiosity, hesitation, or urgency—and adjust responses accordingly. - Dynamic Sales Strategy Adaptation

Select and switch between sales tactics in real time, from highlighting benefits to addressing objections or offering tailored product comparisons, based on live conversational signals. - Comprehensive Insurance Product Knowledge

Instantly retrieve and present accurate, detailed product information, coverage comparisons, and pricing scenarios without disrupting conversational flow. - Personalized Persuasion and Rapport Building

Use empathy-driven language, storytelling, and relatable examples to build trust, strengthen the customer relationship, and guide the conversation toward a decision.

Together, these capabilities enable the voice AI agent to replicate the best practices of top-performing human salespeople—at scale, with consistent quality, and without the limitations of human availability.

How the Currents Social Intelligence Engine is Built to Achieve These Goals

Currents’ Social Intelligence Engine is designed from the ground up to combine strategic adaptability, executional precision, product knowledge scalability, and real-time market awareness into a single, continuously improving sales intelligence system. Its architecture and training approach ensure that our AI voice agents deliver higher conversion rates, faster sales cycles, and more relevant customer experiences in the insurance industry.

1. Four-Layer Agent Architecture We abstract every Currents AI sales agent into four core layers:

- Strategy Layer (t_agent) – The decision-making brain that analyzes the current customer state, predicts possible outcomes, and selects the optimal sales strategy. This layer is continuously improved using reinforcement learning, enabling the agent to adapt over time and discover strategies beyond human performance.

- Execution Layer (t_llm) – Powered by the most advanced large language models, this layer generates persuasive, empathetic, and contextually appropriate dialogue. By keeping this layer independent, we can instantly upgrade to newer LLM technology without retraining the strategy core.

- Knowledge Layer – A decoupled repository of product details, coverage rules, pricing models, and competitive comparisons. This modular design makes the agent highly scalable, allowing rapid switching between insurance products and lines of business with minimal configuration.

- Social Intelligence Search Engine Layer – A live data ingestion and analysis pipeline that continuously gathers product trends, authentic customer feedback, and sentiment shifts from social networks and public channels. The resulting insights are fed directly into the strategy layer, giving the agent market-relevant context for more targeted and effective conversations.

This layered architecture allows Currents’ agents to seamlessly combine long-term strategic optimization with instantaneous execution and real-world market intelligence.

2. Reinforcement Learning for Continuous Strategy Optimization

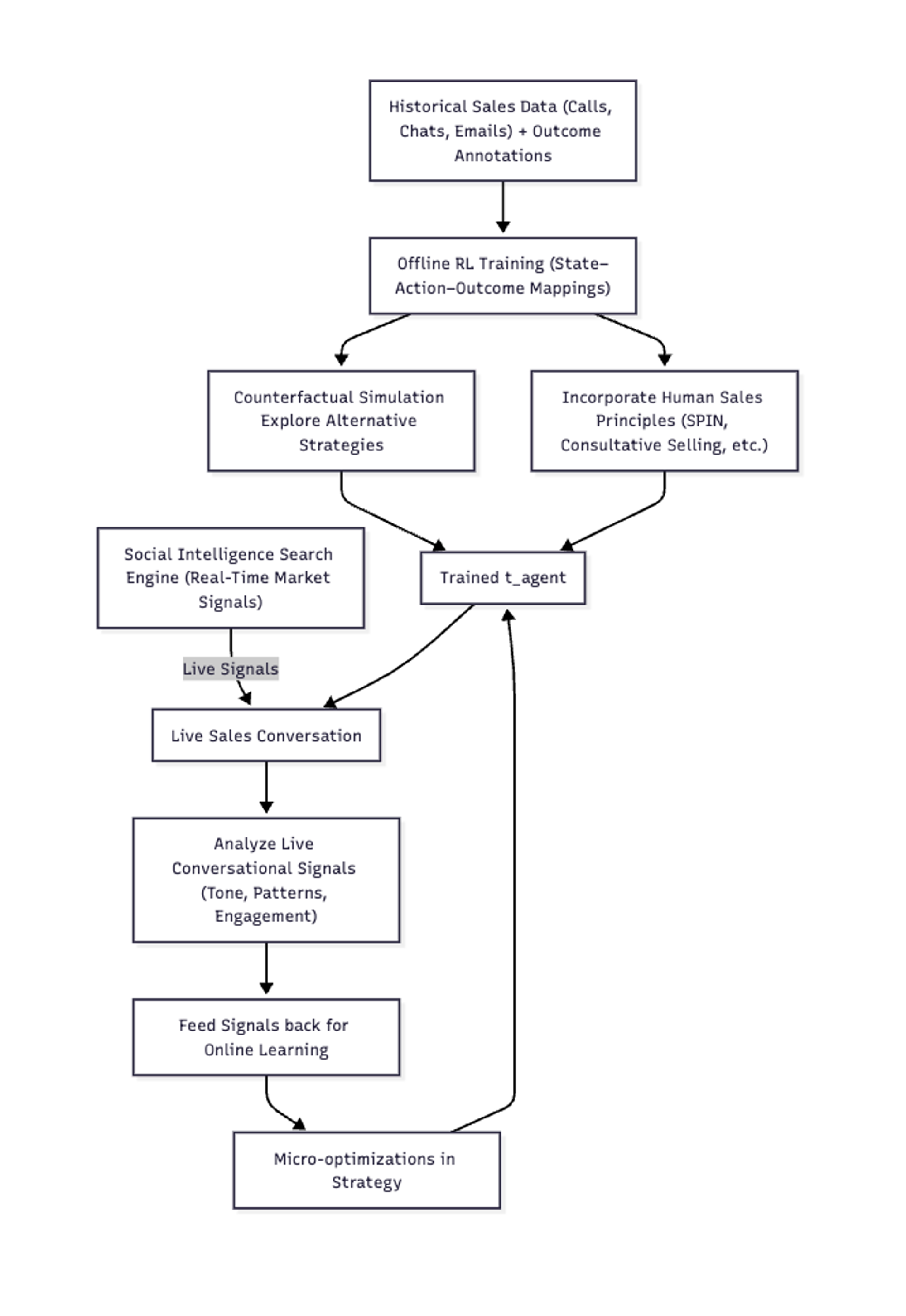

The t_agent is trained using offline reinforcement learning on a representative dataset of sales interactions, annotated with outcomes such as conversion, engagement depth, and follow-up success. This historical training foundation is complemented in live operations by real-time market insights from the Social Intelligence Search Engine, ensuring both strategic consistency and situational adaptability.

- The RL framework learns state–action–outcome mappings, enabling the agent to predict which strategies are most effective for given customer profiles and contexts.

- Beyond replicating human decisions, the RL process simulates counterfactual scenarios—exploring alternative strategies that could have produced better outcomes.

- The agent’s training also incorporates advanced sales methodologies (e.g., SPIN selling, consultative selling) so that it is grounded in proven human sales principles while still benefiting from data-driven optimization.

During live sales interactions, the Social Intelligence Search Engine continuously feeds the t_agent with real-time market signals—such as emerging objections, trending value propositions, and shifting customer priorities—so that the agent can adapt its strategy on the spot, aligning each conversation with the most relevant and timely context available.

3. Continuous Online Learning

In live deployment, the Currents Social Intelligence Engine does not remain static—it continually evolves through an online learning loop:

- Every customer interaction is analyzed for conversational signals such as tone shifts, question patterns, and engagement markers.

- These live signals are fed back into the t_agent’s decision framework to adjust strategy parameters on the fly.

- The system performs micro-optimizations in near real time, refining which strategies are selected in similar situations in the future.

This combination of modular architecture, reinforcement learning from rich historical data, and continuous online adaptation ensures that Currents’ socially intelligent voice AI agents are always operating at the intersection of product expertise, human-like empathy, and current market reality—delivering measurable gains in efficiency, conversions, and customer satisfaction.

From Technology to Impact: Real-World Advantages in Insurance Sales

While the architecture, reinforcement learning framework, and continuous adaptation mechanisms define the technical foundation of Currents’ Social Intelligence Engine, the ultimate measure of value is its impact in real insurance sales environments. Our voice AI agents deliver measurable business advantages:

- Higher Sales Efficiency – Agents qualify leads faster, handle more simultaneous conversations, and reduce average handling time without compromising quality.

- Increased Conversion Rates – Data-driven strategies and real-time market awareness ensure that each customer interaction is relevant, timely, and persuasive.

- Scalable Product Knowledge – The decoupled knowledge layer enables instant adaptation to new insurance products or market offerings without re-engineering the core agent.

- Consistent, Human-Like Experience – Emotional intelligence, empathy-driven dialogue, and dynamic strategy shifts make interactions feel authentic while maintaining professional accuracy.

These capabilities translate technology into tangible performance gains—shorter sales cycles, more policies closed, and a consistently better customer experience.

In this white paper, we have outlined how Currents’ socially intelligent voice AI agents combine strategic adaptability, empathetic execution, scalable product knowledge, and real-time market awareness to transform insurance sales. From initial lead qualification to final policy closing, these capabilities work together to deliver measurable gains in efficiency, conversion, and customer experience—empowering insurers to sell smarter, faster, and with greater impact.